UNIT 2

BACK TO BASICS

CANDLE REVIEW

CANDLE ANATOMY

CLOSING PRICE

Price point where the

candle closes

OPENING PRICE

Price point where the candle opens, also where the next candle will open

CANDLE WICK HIGH

Highest point price reached

CANDLE BODY

Reflects where price stayed for most of the candle

CANDLE WICK LOW

Lowest point price reached

CANDLE WICKS

For bullish candles

WICK RANGES

Wicks on candles are also ranges, however they are ranges on the smaller time frame - this is explained in further detail in Advanced Concepts

OPENING WICK

The opening of the next candle typically retraces a portion of the previous candle before continuing with its direction

Wicks will tell us if price is creating *structure as it is continuing in its direction.

In the case that its not, we can make more informed decisions on what price may want to do

The opposite applies for bearish candles

*Structure is the ability for price to create highs and lows so that price can 'drive' from a support

No Top/Bottom Wick

UNCERTAINTY

Candles that have no wicks give us less information on where it wants to go. As wicks are also ranges, a candle with a wick has left a range for the next candle to fill

Because of this, the candle has an uncertain chance of pushing up or retracing back down. We don't want to guess because it would be equivalent to gambling

SIGNS OF RETRACEMENT

Typically, we see price either reverse or retrace to grab more liquidity before continuing in its initial direction

However, it can also drive straight through like in the market example: price kept going

XAUUSD Market Example

'Le' Candle

Signs

The le candle is a name given to a candle which is showing signs of difficulty pushing in its current direction

More often than not these candles have a small body and leave a small wick or no wick for its next candle to fill

They also tend to have a long rejection wick which we can associate to signs of rejection and incoming change of structure

XAUUSD Market Example

Situation Based

With situations such as these, it really depends on what has happened leading up to the Le candle

Liquidity has a massive impact on how price action may play out

MARKET STRUCTURE

BULLISH TREND

BREAKOUTS & CONTINUATIONS

Ranges are still formed but price tends to break above and continue driving towards the next resistance

HIGHER HIGHS

In a bullish trend, price will continue to create higher highs and push price up, this will usually happen until price reaches a HTF resistance

minor resistance

LOWER LOWS

Alongside higher highs, price will create higher lows

Sometimes when price is grabbing Liquidity, it can break a previous low before rebreaking

its latest high

Liquidity Example

BEARISH TREND

LOWER HIGHS

As price continues to drive down, market structure will create lower highs

minor support

LOWER LOWS

In a bearish trend, price will continue to create lower lows and drive price down. This will usually happen until price reaches a HTF support

LIQUIDITY

When accounting for Liquidity, we may occasionally see a rebreak of a previous high before rebreaking its latest low

Liquidity Example

RANGES

SUPPORT & RESISTANCE

Whilst in a range, price respects support and resistance levels

ESTABLISHED RESISTANCE

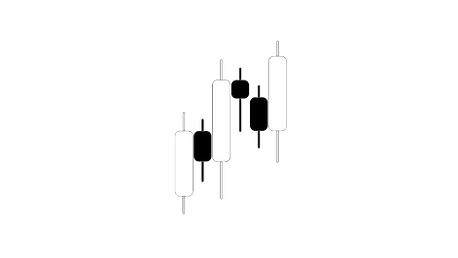

Resistances at the top of a range is established with one bullish candle followed by one bearish candle

ESTABLISHED SUPPORT

Supports are formed with one bearish candle followed by a bullish candle

Occasionally you may get fakeouts, which are breakouts from the range, followed by closures back into the range.

This is also a form of liquidity

Fakeout Example

CHANGE OF STRUCTURE

LIQUIDITY & LOWER HIGH

BREAK OF PREVIOUS LOW

CONFIRMED LOWER LOWS

BEARISH STRUCTURE CONTINUATION

REACTION BASED TRADING

We don't need to predict or guess where structure is changing, just watch price and it will tell you

LIQUIDITY OR STRUCTURE CHANGE

When price is trending in a direction, a sudden change in market structure can be confusing

in Advanced Concepts we'll touch on how to differentiate between liquidity and actual market structure change

DVS SETUPS

BREAKOUTS

INTO THE NEXT RANGE

Breakouts refers to a candle closure above or below an established range, which usually is a good indication of volume

Breakouts can either be a sign of direction for price to continue with its previous trajectory, or it can also lead to liquidity or fakeouts

Use all time frames to determine which one is more likely to happen

FAKEOUTS

THE WRONG WAY

A fakeout is defined as a breakout in the opposite direction of the way price is currently pushing, followed by a closure back into the previous range and a continuation in the previous direction of price

When price is trending and pushing in a direction, it may require more liquidity to continue pushing. Usually this can be in the form of a fakeout

Make sure to remember the direction of travel for price so you do not get faked out and stuck in a losing position

ONIONS

TRADING THE RANGE

When trading in a range, we need the price to establish both a support and a resistance level (in any order). We refer to this as an 'onion'

Once these levels are set, we look for a simple range fill in the direction of momentum

Alternatively, you can view this as waiting for a higher low to form, then trading the confirmation of support into a higher high (in a bullish trend)

ADVANTAGE POINTS

HIGH PROBABILITY PRICE ACTION

Based off of previous price action, we have some indication of where price could tap into - following a breakout, price is likely to fill the next range

The overall range fill is usually our full TP as there is a high probability that price will tap that level

We can also use the break of the previous wick high as an intermediate advantage point, but to use this, we usually would like to see a bottom wick formed

This bottom wick is a stronger confirmation that price will not come back up as after the bottom wick (lower low) a rebreak of the highs (higher high) is usually followed by a push

previous

price action

OVERALL TP

ADVANTAGE POINT 1

ENTRY POINT

BREAKOUT

CONFIRMATION

UNIT 2

ADVANCED CONCEPTS

READING CANDLES BACKWARDS

WHY DO WE READ CANDLES BACKWARDS?

Reading candles backwards is a phrase we use to describe breaking down each individual HTF candle into its smaller components so that we can be more informed in our decision making and understanding of price action

At first, this is quite difficult to understand and use in your daily analysis, however, this is a key component of mastering technical analysis and price action. Candles tell you all the information about what price wants to do, and our job is to get a full picture using all the timeframes from HTF to LTF

1H

CANDLE STRUCTURE

30M

CANDLE STRUCTURE

15M

CANDLE STRUCTURE

{

{

4H RESISTANCE

4H SUPPORT

}

}

B

A

C

D

E

F

A Sometimes ranges can't be seen on the HTF, but is very clear on the LTFs

B Established range on the HTF will contain multiple ranges on the LTF

C Bottom wicks for previous candles. A standard 1H bullish candle can be broken down into four 15M candles where its story can be told in a very different way. Within this 1H candle, price grabbed liquidity and created a bottom wick for a no bottom wick previous 15 minute candle

D Breakout after liquidity. After grabbing liquidity, price once again breaks above recent highs. This time, we can be more confident that price will continue driving up, but we still need a breakout closure as confirmation

E 30M candle bottom wick for previous candle

F Fakeouts on HTF charts are just wicks, only on the LTFs can you see the full picture. Here you can clearly see a fakeout forming, which is enough liquidity for price to re-break the highs to continue its bullish structure

LIQUIDITY

NOTICING MARKET PATTERNS

Initially, we noticed that we were getting faked out relatively often. We adapted to the fakeouts and as we started watching fakeouts happen whilst we were patient on the charts, we asked ourselves: "Why does price create fakeouts?"

To answer this question, we paid more attention to what happens before and after fakeouts

BEFORE A FAKEOUT:

Price typically is ranging and has no direction. Often times, there is also less volume in the markets.

AFTER A FAKEOUT:

Price usually picks up more volume and is moving much quicker. It sometimes takes more time for price to choose its direction, but the fakeout usually turns into one of two scenarios:

1. Continuation and Rebreak of Highs/Lows

2. Market structure shift and a reversal after a top/bottom wick is created

LIQUIDITY

Our understanding of price action around the fakeout led us to understand that price sweeps highs/lows and creates steeper bottom wicks. This sweep usually breaks a previous structure point and mimics historic price action

RANGING

Price action before the fakeout and before liquidity tends to range. Typically price moves slower as there is less volume as well

BREAK OF STRUCTURE

For price to continue going up with the HTF, price will need to grab liquidity before continuing in its original direction

The liquidity typically exists as a steep wick, or on the LTF, a potential break of structure and fakeout

CONTINUATION

Price rebreaking highs/lows is a good indication of continuation. With liquidity, it typically increases the probability of this trade playing out in our favor

ENTRIES AND LIQUIDITY

PRICE ACTION WITHOUT LIQUIDITY

RISK OF STRUCTURE SHIFT

Without liquidity, there is a higher chance that price will reverse and break structure

Price never continues in the same direction infinitely and retracement is always a possibility

As such, Market structure is very important and will largely determine whether or not price has what it needs to continue

Minor Resistance

HTF VIEW 1H

Minor Resistance

LTF VIEW 30M

There is a very high chance that this market reversal is a HTF liquidity grab. On the LTF, it will look like a market reversal and structure shift

PRICE ACTION WITH LIQUIDITY

LOWER RISK

As price grabs liquidity, on the LTF it will look like a fakeout. On the HTF price will have created a steeper wick

Because price has already attempted to continue downwards, there is a much higher chance that price will have chosen its direction

Minor Resistance

HTF VIEW 1H

A Le Candle Forming

Minor Resistance

LTF VIEW 30M

This is where we can take our opportunity in the market. With further confirmations such as a breakout closure, the likelihood of price action continuing will be very high